gilti high tax exception pwc

The Treasury Department and the IRS Treasury on July 20 2020 released Final Regulations and Proposed Regulations under Section 951A as enacted by the 2017 tax reform. Although Branch B paid 75 of foreign taxes only 50 can be claimed as a tax credit in the current years return based on the FTC limitation.

Doing Business In The United States Federal Tax Issues Pwc

June 25 2019 GILTI as charged Part 2.

. US Tax Readiness. Gilti High Tax Exception Regulations will sometimes glitch and take you a long time to try different solutions. Department of the Treasury and the IRS agreed and added the GILTI high-tax exclusion HTE when the final GILTI regulations were released in July 2020.

The Senior Homestead Exemption is granted to owner-occupied properties if the owner is 65 years of age or older and was the owner-occupant of the property on January 1st of the. The High Tax Exception - GILTI and Subpart F US Treasury released Final and Proposed Regulations relating to the treatment of income that is subject to. LoginAsk is here to help you access Gilti High Tax Exception Regulations.

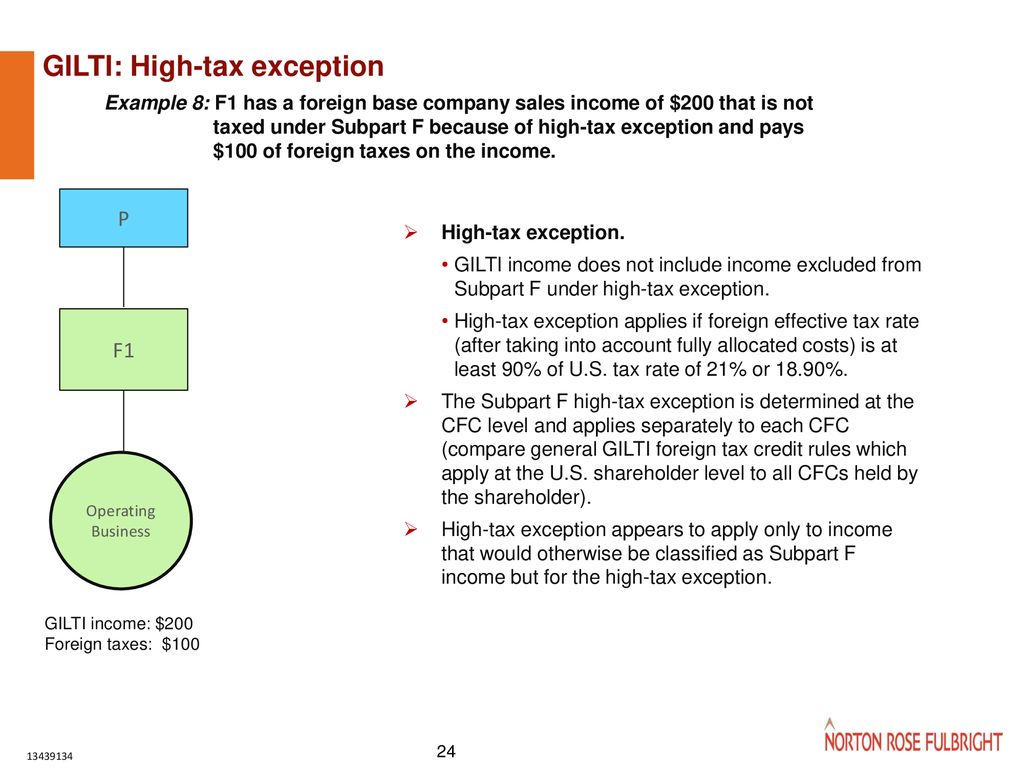

The high-tax exclusion applies only if the GILTI was subject to foreign income tax at an effective rate greater than 189 90 of the highest US. Corporate tax rate which is. Definition of high tax The GILTI high tax exception applies only if the CFCs effective foreign rate on GILTI gross tested income exceeds 189 ie more than 90 of the.

On June 1 2021 the Illinois Legislature approved the states FY 2022 budget legislation Senate Bill 2017 which includes provisions that would modify Illinoiss income franchise and. The remaining 25 would be carried forward. In this podcast elizabeth nelson partner pwc international tax services marty hunter partner pwc international tax services nita asher principle pwc international tax.

The Final Regs and High Tax Exception Doug McHoney PwCs International Tax Services Leader interviews Elizabeth Nelson.

Gilti Conscience Casual Discussions On Transfer Pricing Tax Treaties And Related Topics Insights Skadden Arps Slate Meagher Flom Llp

Julie Sorenson Julieasorenson Twitter

Highlights Of The Final And Proposed Gilti Regulations Pwc

Cross Border Tax Talks Podcast Addict

U S Cross Border Tax Reform And The Cautionary Tale Of Gilti

U S Cross Border Tax Reform And The Cautionary Tale Of Gilti

Irs Issues Gilti Accounting Method Change Procedures Pwc

Hard Hit On Global Supply Chain Structures Ppt Download

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Us Tax Readiness The High Tax Exception Gilti And Subpart F Pwc Suite

Crystal Poon International Tax Director American Express Linkedin

Tony Beckman On Linkedin Pwc S Tax Readiness Webcast How Does Current Law Interact With Pillar

Tony Beckman On Linkedin Pwc S Tax Readiness Webcast How Does Current Law Interact With Pillar

Gilti Global Intangible Low Taxed Income U S Taxation Youtube

Highlights Of The Final And Proposed Regulations On The Gilti High Tax Exclusion True Partners Consulting

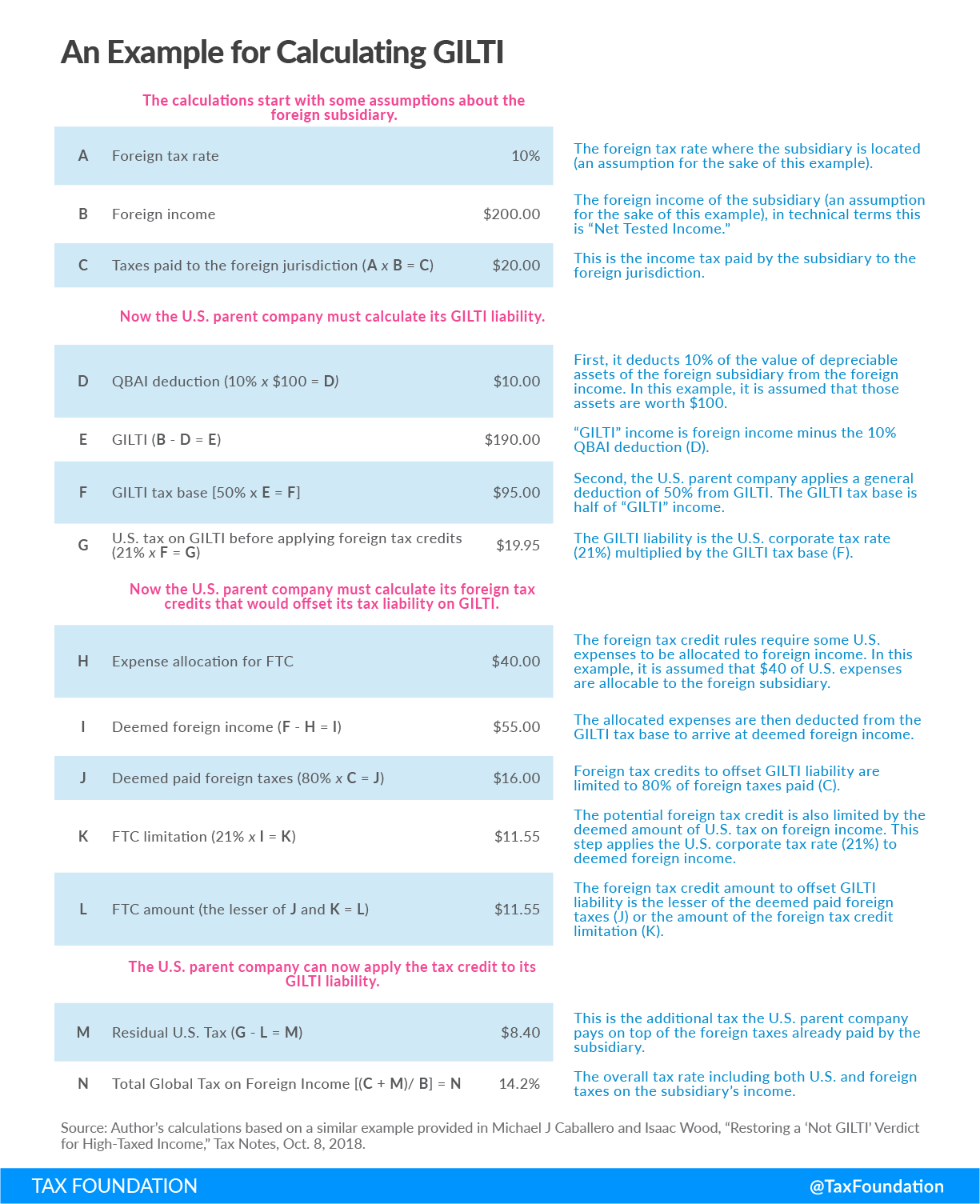

Gilti By Country Is Not As Simple As It Seems Tax Foundation